Cash Receipt Format in Word

Create and share professional cash receipts effortlessly! Download a ready-to-use Cash Receipt Format in Word to record payments, track transactions, and streamline your business operations.

Cash Receipt Format vs Vyapar App

Cash Receipt Format

Billing Software

Price

Free

Free

200+ Professional Formats

Quick Billing

Unlimited Invoices

Auto Calculation

Error-Free Transactions

Data Backup

UPI Payments

Payment Reminders

Business Status Reports

Download The Cash Receipt Formats in Word For Free

Download professional free Cash Receipt Formats, and make customization according to your requirements at zero cost.

Customize Invoice

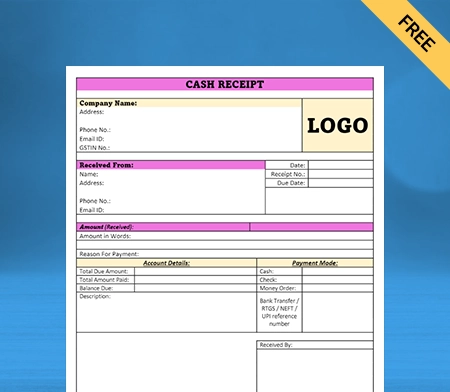

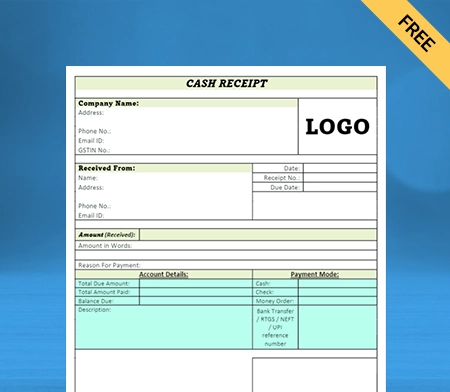

Type – 1

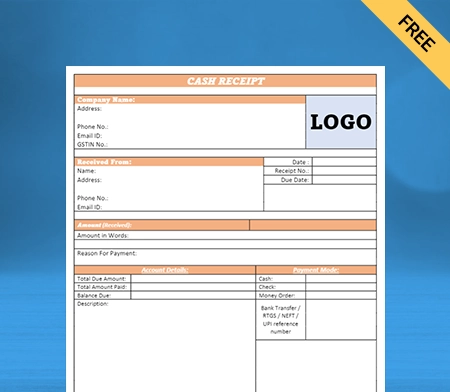

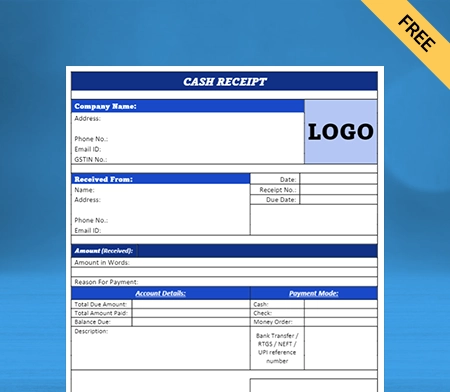

Type – 2

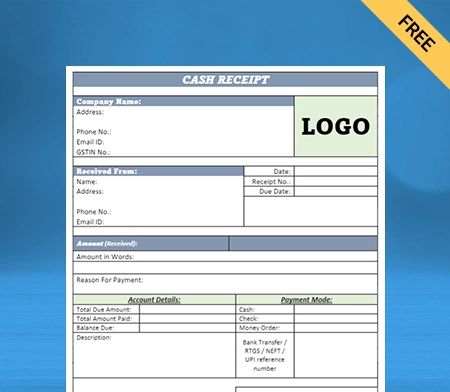

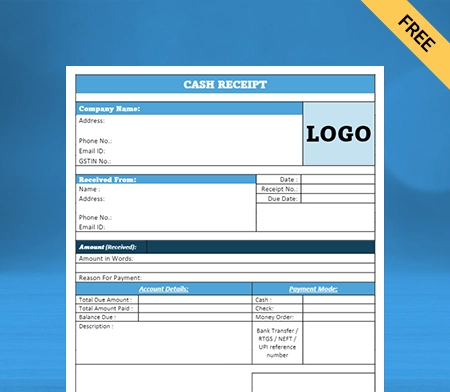

Type – 3

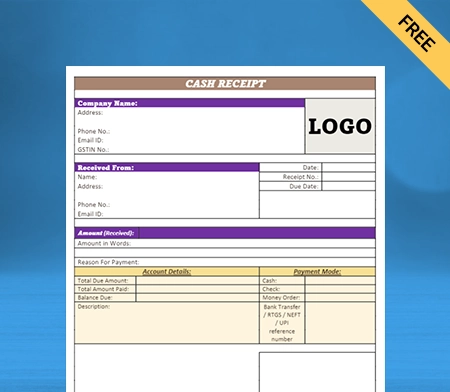

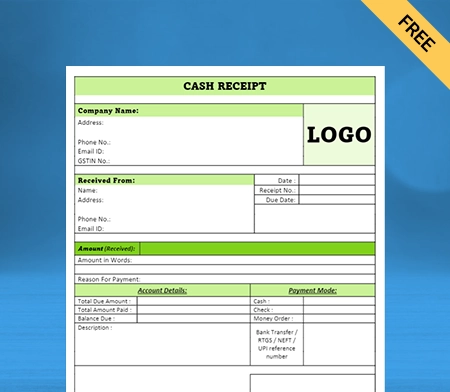

Type – 4

Type – 5

Type – 6

Type – 7

Type – 8

Use Premium Template to Create Cash Receipts. Try Vyapar for FREE!

What Is a Cash Receipt Format in Word?

A cash receipt format in Word is a ready-to-use template designed to help you create cash receipts quickly and professionally. Instead of building one from scratch every time, you can use this format to fill in the necessary details within minutes and issue a receipt on the spot.

Using a pre-designed Word format not only saves time but also ensures consistency in your business documentation. Whether you’re handling sales, collecting rent, or receiving payments for services, having a standard format makes the process smoother and more reliable.

We also provide a cash receipt voucher format in Word, which is perfect for recording transactions like advance payments or cash transfers in a simple and structured way.

Now, let’s understand what a cash receipt actually is.

A cash receipt is a document that confirms a payment has been received by a business from a customer. It’s usually issued after a transaction is completed and serves as a formal record for both parties.

While it may seem like a basic piece of paperwork, a cash receipt plays two important roles:

- It helps businesses maintain accurate records. By tracking sales and payment details, it supports inventory management and simplifies accounting.

- It offers clarity to customers, especially those who work with third parties. For example, if your customer needs to report expenses or claim reimbursements, the receipt serves as reliable proof of when and how the cash was spent.

So, even though a cash receipt format in Word may seem like a small tool, it can significantly improve how you manage and document your business transactions.

Importance of Using Cash Receipts for a Small Business

Issuing cash receipts might seem like a small operational task, but for any small business, it’s a big step toward better financial management and transparency. Whether you’re just starting out or looking to improve your internal processes, consistently using cash receipts can bring several long-term advantages.

Here’s why issuing cash receipts is so important for small businesses:

Helps in the Auditing Process

If your business is registered, you already know how crucial audits are. They help uncover discrepancies, ensure compliance, and identify inefficiencies—especially in accounting.

Having a well-maintained record of sales is key to making the auditing process smooth and hassle-free. Cash receipts serve as part of that record. They provide a clear, organized log of every transaction, making it easier for auditors to verify your financial data without unnecessary back-and-forth.

Acts as Proof of Sale

A cash receipt is more than just a slip of paper—it’s legal proof that a transaction took place. It confirms that your customer has purchased a product or service and that payment was received.

In the event of a legal dispute or any customer-related confusion, cash receipts can act as your first line of defense. They show exactly what was sold, when it was sold, and for how much—helping you avoid misunderstandings and protect your business.

Simplifies Account Management

When you’re handling multiple transactions daily, it’s easy for small details to slip through the cracks. Over time, these small gaps can lead to major errors in your accounts.

Cash receipts make tracking each transaction simple. With a proper receipt format, you can log sales consistently, track payments, and reduce the chance of mistakes in your bookkeeping. This leads to more accurate financial statements and fewer headaches at the end of the financial year.

Supports Inventory Management

If your business sells physical products, maintaining the right inventory levels is crucial. Issuing cash receipts helps you keep a real-time record of what’s being sold.

This data is invaluable when it comes to forecasting demand, identifying fast-moving items, and restocking on time. The better you track your sales through receipts, the easier it becomes to maintain a well-stocked and customer-ready business.

Saves Time During Financial Reviews

Audits and internal financial reviews can be time-consuming—but not if your records are in order. When every transaction is backed by a clear and organized receipt, it’s much easier to analyze your cash flow and spot inconsistencies.

Cash receipts give auditors a reliable trail to follow. Instead of digging through unclear entries or guessing figures, they can directly refer to your receipts to verify the accuracy of your books.

Additional Information (Optional):

- Payment terms: This specifies how and when the payment is due.

- Signature of the supplier: While not always mandatory, a signature adds authenticity to the invoice.

Remember, these are the key components and specific formats or additional information may be required depending on the type of transaction or government regulations.

Benefits of Using a Professional Cash Receipt Format in Word

Issuing cash receipts might seem like a simple task, but it offers a wide range of benefits for both you and your customers. From better financial organization to smarter marketing, using a professional cash receipt format in Word can enhance how your business operates day to day.

1. Provides Convenience During Tax Filing

Tax season can be stressful, but having organized cash receipts makes the process much easier. Your cash receipts serve as a clear record of sales, helping you and your accountant verify income, claim expenses, and calculate accurate taxes.

Receipts that include tax details like GST help avoid errors in tax filing, protecting your business from potential penalties. And when you use accounting software like Vyapar, your cash receipts are automatically formatted for compliance—making tax filing even more seamless.

2. Doubles as a Marketing Tool

Marketing doesn’t always have to cost a fortune. In fact, your cash receipts can act as an underrated branding opportunity. By adding your business logo, tagline, or contact information, each receipt becomes a small but effective brand touchpoint.

Even in tight budget scenarios, this is a cost-effective way to reinforce your brand with every customer interaction. With customizable receipt templates available in the Vyapar app, you can make every receipt look professional and on-brand.

3. Promotes Safer, Eco-Friendly Practices

Digital receipts aren’t just convenient—they’re also safer and better for the environment. Traditional thermal paper receipts often contain BPA, a chemical linked to health concerns. By offering digital receipts using tools like Vyapar, you eliminate this risk entirely.

Digital receipts also reduce paper waste and demonstrate your commitment to sustainable practices, which can enhance your reputation with environmentally conscious customers.

4. Helps You Track and Manage Expenses

Cash receipts provide essential details about every transaction, including items sold, prices, and taxes. These details make it easier to track your daily income and expenses.

Over time, analyzing your receipts can help you understand where your money is going, identify areas to cut costs, and get a clearer picture of your profitability and cash flow. Using a structured Word format or an accounting tool like Vyapar ensures all the right information is captured for easy review.

5. Easy to Share With Customers

Speed and convenience matter, especially when you’re serving customers in real time. With software like Vyapar, you can instantly send receipts via WhatsApp, email, or SMS—no printing or physical handling required.

This not only saves time but also improves the customer experience. Your customers walk away with a clean, professional receipt in seconds—without waiting or worrying about lost paper copies.

Essential Components of a Cash Receipt Format in Word

A well-designed cash receipt format in Word should include specific details that make it easy to use, legally valid, and helpful for both the business and the customer. Having a clear understanding of these components ensures you don’t miss anything important while creating or customizing your own format.

Below are the key elements every effective cash receipt format in Word should include:

Transaction or Invoice Number

Including a unique invoice or transaction number is especially important if your business is GST-registered. This number helps you stay compliant with tax regulations and makes tracking transactions much easier.

We recommend placing the invoice number at the top of your receipt format. It benefits you by simplifying the process of tracking GST, sales, and payment histories. For your customers, it’s equally helpful—especially when they’re organizing receipts for returns, reimbursements, or tax filing.

Date and Time of Issue

Every cash receipt should clearly show the date and time when the transaction took place. These details are typically placed near the top of the receipt and help establish a reliable record of the payment.

If you’re creating receipts manually in Word, you’ll need to input the date and time yourself. However, if you’re using billing or accounting software like Vyapar, these fields are auto-filled, saving you time and reducing the chance of errors.

Business Name and Address

To ensure your receipt is easily identifiable, always include your business name and address. This helps distinguish your receipt from others your customer might receive and reinforces your brand’s credibility.

You can place your business name and logo at the top, with the address either directly below or at the bottom. Including your contact details also makes it easier for customers to reach out to you if they have questions or need to revisit the transaction.

Product or Service Details with Pricing

This section forms the core of your cash receipt. Clearly list the products sold or services provided, along with their individual prices. Use a dedicated table or column to organize this information neatly.

Providing itemized pricing not only helps you track sales accurately but also allows your customers to see exactly what they’re paying for—boosting transparency and professionalism.

Subtotal and Tax (If Applicable)

No receipt is complete without a total amount field. After listing all items or services, your format should include a section that summarizes the full payment amount, ideally at the bottom of the receipt.

If your business is registered under GST or another tax regime, it’s best to show the tax amount separately from the subtotal. While some businesses include the tax in the total and don’t mention it explicitly, being transparent about GST can build trust and help during audits or tax filing.

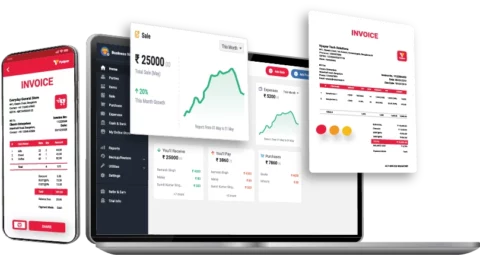

How to Create a Cash Receipt Using the Vyapar Accounting App?

If you’re using the Vyapar accounting app for the first time, creating a cash receipt might feel a bit unfamiliar. But don’t worry — the process is quick, easy, and designed to be beginner-friendly.

Here’s a simple step-by-step guide to help you create a cash receipt using the Vyapar app:

Step-by-Step: Create a Cash Receipt in Vyapar

- Open the Vyapar App – Start by launching the app on your mobile or desktop device.

- Tap on “Add Sale” – At the bottom of your screen, you’ll see an ADD SALE button — tap on it to begin.

- Choose “Cash” as the Payment Type – From the top menu, select CASH to indicate the mode of payment for the transaction.

- Select the Invoice Number and Date – Enter the invoice number and the current date when the transaction is taking place.

- Add Customer Details – Input the customer’s full name and phone number to personalize and track the transaction.

- Add Items Sold – Tap on ADD ITEM and fill in the product or service details, including quantity and price. The app will automatically calculate the total amount.

- Confirm Payment Mode – Choose Cash as the payment medium, then tap on SAVE to generate the receipt.

- View and Share the PDF Receipt – Once saved, a PDF version of the cash receipt will appear on your screen. Tap the share icon to send the receipt directly to your customer.

One of the best features of the Vyapar app is how easily you can share receipts. Whether your customer prefers WhatsApp, Gmail, or other platforms, Vyapar gives you multiple sharing options with just a tap.

Need a physical copy? No problem. Vyapar is compatible with a wide range of printers, so you can print a hardcopy instantly and hand it over to your customer.

So What are you waiting for?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

What is a Cash Receipt Format in Word?

What are some examples of cash receipts in Word?

How do I create a cash receipt in Word?

How many types of cash receipts are there?

1. Capital Receipts: Received during non-regular business activities, like loans or asset sales.

2. Revenue Receipts: Received through normal operations like sales, service income, or rent.

Is the Cash Receipt Format in Word free?

Can I create a cash receipt format online?